All Categories

Featured

Table of Contents

Annuities are insurance coverage products that can eliminate the risk you'll outlast your retired life savings. Today, because less people are covered by traditional pensions, annuities have become progressively prominent. They can usually be integrated with various other insurance coverage items, like life insurance policy, to produce full defense for you and your family. It prevails today for those approaching retirement to be concerned regarding their cost savings and for how long they will last.

You make an exceptional payment to an insurance coverage firm, either in a swelling sum or as a collection of repayments. In return, you'll get normal revenue for a specified duration, frequently for life.

Annuities are no different. Take an appearance at some of the key benefits of annuities contrasted with other retirement financial savings cars: Annuities are the only economic item that can give you with assured life time earnings and guarantee that you are never ever at danger of outlasting your savings.

As holds true with many retired life savings cars, any profits on your deferred annuity are tax-deferred. That indicates you do not pay taxes on the growth in your account up until you withdraw it or start taking payments. In other words, the taxes you 'd typically owe on the gains yearly continue to be in your account and expand, typically leaving you with greater balances down the road.

What is the process for withdrawing from an Lifetime Payout Annuities?

1 To locate the most effective product for you, you'll require to shop around amongst relied on insurance policy service providers. Among the advantages of annuities is that they are very adjustable. The best annuity for you is mosting likely to depend on numerous aspects, including your age, your present savings, just how long you need the revenue, and any defenses you might desire.

2 Below are a number of common examples: You and your partner are planning to retire within the following few years. You've both conserved a good quantity yet are now attempting to crunch the numbers and see to it your cost savings will certainly last. It's usual to fret over exactly how much of your savings to access every year, or how much time your financial savings will require to last.

3 That means, you and your partner will have income you can depend on no matter what takes place. On the other hand, allow's claim that you're in your late 20s. You've lately had a good raise at work, and you wish to ensure you're doing whatever you can to assure a comfy retirement.

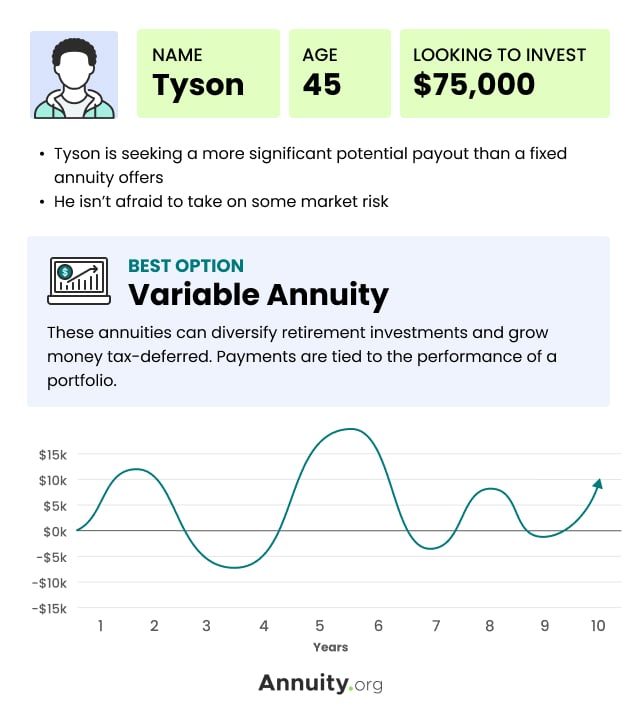

That's a terrific begin. However retired life is a long means off, and who recognizes just how much those savings will certainly grow or if there will certainly be sufficient when you get to old age. A variable deferred annuity could be something to contribute to your retirement. Some annuities permit you to make exceptional settlements each year.

What is the process for withdrawing from an Annuity Accumulation Phase?

The annuity will have the chance to experience development, yet it will certainly likewise go through market volatility. New York City Life has several alternatives for annuities, and we can aid you customize them to your family's distinct needs. We're right here to aid. We can walk you with every one of your options, with no pressure to get.

The purchaser is often the annuitant and the person to whom periodic repayments are made. There are two basic kinds of annuity agreements: instant and deferred. A prompt annuity is an annuity contract in which repayments start within twelve month of the date of acquisition. The prompt annuity is bought with a solitary premium and regular repayments are generally equivalent and made month-to-month, quarterly, semi-annually or every year.

Routine payments are deferred up until a maturity date stated in the contract or, if earlier, a day picked by the proprietor of the agreement - Tax-deferred annuities. One of the most typical Immediate Annuity Agreement settlement choices include: Insurance firm makes periodic settlements for the annuitant's lifetime. An alternative based upon the annuitant's survival is called a life section option

There are 2 annuitants (called joint annuitants), usually partners and regular repayments continue up until the death of both. The income repayment amount may continue at 100% when just one annuitant is to life or be reduced (50%, 66.67%, 75%) during the life of the making it through annuitant. Routine repayments are produced a specified amount of time (e.g., 5, 10 or two decades).

How do I cancel my Variable Annuities?

Revenue settlements stop at the end of the period. Payments are generally payable in fixed dollar amounts, such as $100 per month, and do not provide protection versus rising cost of living. Some prompt annuities give rising cost of living defense with periodic rises based upon a fixed rate (3%) or an index such as the Consumer Cost Index (CPI). An annuity with a CPI adjustment will start with lower repayments or require a higher initial costs, yet it will certainly supply a minimum of partial protection from the danger of inflation.

Revenue repayments continue to be consistent if the investment performance (besides costs) equals the assumed investment return (AIR) mentioned in the agreement. If the investment efficiency exceeds the AIR, payments will certainly increase. If the investment efficiency is much less than the AIR, repayments will certainly reduce. Immediate annuities typically do not permit partial withdrawals or attend to cash abandonment advantages.

Such persons must look for insurance firms that use low quality underwriting and consider the annuitant's health and wellness condition in establishing annuity revenue settlements. Do you have adequate financial sources to meet your revenue requires without acquiring an annuity?

Lifetime Payout Annuities

For some choices, your health and marital condition might be thought about. A straight life annuity will certainly supply a greater regular monthly revenue repayment for a given costs than life contingent annuity with a duration certain or refund feature. To put it simply, the price of a given revenue repayment (e.g., $100 monthly) will be greater for a life contingent annuity with a period specific or reimbursement feature than for a straight life annuity.

An individual with a dependent partner may want to consider a joint and survivor annuity. A person concerned with getting a minimal return on his/her annuity premium may desire to think about a life section alternative with a duration specific or a refund attribute. A variable instant annuity is usually chosen to equal inflation throughout your retired life years.

A paid-up deferred annuity, likewise typically described as a deferred revenue annuity (DIA), is an annuity contract in which each costs payment purchases a set dollar income benefit that starts on a defined day, such as an individual's retired life date. The contracts do not preserve an account value. The costs cost for this item is much less than for an immediate annuity and it enables an individual to maintain control over many of his/her various other properties during retired life, while protecting longevity protection.

Table of Contents

Latest Posts

How can an Annuity Payout Options help me with estate planning?

Why is an Tax-deferred Annuities important for my financial security?

How do Secure Annuities provide guaranteed income?

More

Latest Posts

How can an Annuity Payout Options help me with estate planning?

Why is an Tax-deferred Annuities important for my financial security?

How do Secure Annuities provide guaranteed income?